Solana (SOL) has demonstrated remarkable strength in the cryptocurrency market, posting a significant 9.15% gain in the last 24 hours. Currently trading at $266.03, SOL shows promising signs of continued upward momentum as it approaches key resistance levels.

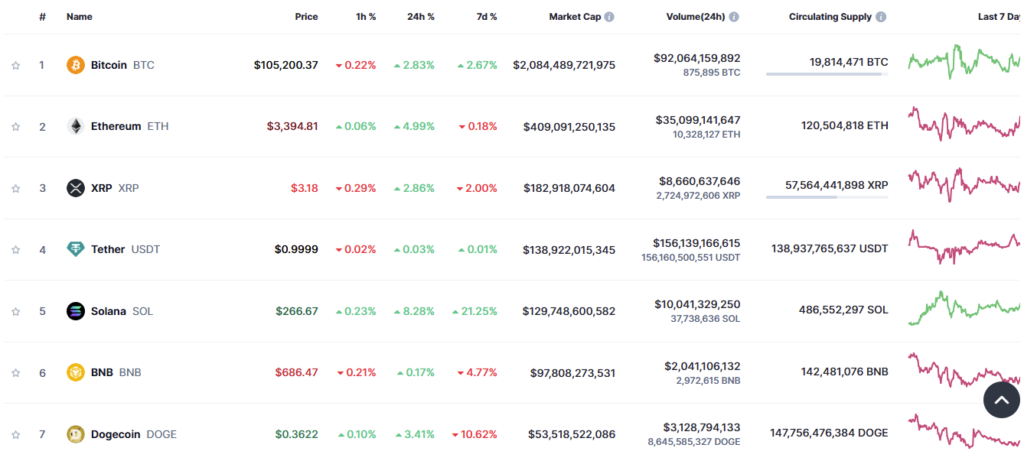

Top cryptocurrencies | Source: Coinmarketcap

Current Market Snapshot

The digital asset has captured market attention with its impressive performance. With a market capitalization of approximately $129.65 billion, Solana maintains its position as a leading cryptocurrency. The substantial trading volume indicates strong market participation and interest in SOL’s price movement.

Breaking Down Key Price Levels

Critical Resistance Zone

Traders are closely watching the $270 level, which represents immediate resistance for Solana. Market analysts suggest that a daily closing price above $270.67 could signal sufficient buying pressure to fuel further gains. This technical milestone could prove crucial for SOL’s short-term price direction.

Image by TradingView

Path to Higher Targets

If Solana successfully breaks through the $270 barrier, the next significant target lies in the $280-$290 range. Technical indicators support this potential upward movement, with some analysts projecting a possible test of the $300 mark before January ends.

Market Drivers Behind the Rally

Regulatory Tailwinds

Recent developments in the U.S. regulatory landscape have boosted market sentiment. President Trump’s executive order regarding digital asset reserves has created a more favorable environment for cryptocurrency growth, potentially benefiting Solana’s market position.

Technical Strength

The current price action shows strong technical foundations. Multiple indicators align with the bullish outlook, suggesting that SOL’s upward trajectory could continue if current support levels hold.

Trading Volume and Market Activity

High trading volumes accompany SOL’s price increase, lending credibility to the current movement. This robust market activity suggests genuine investor interest rather than temporary price fluctuations.

Short-Term Price Outlook

The immediate focus remains on the $270 resistance level. A breakthrough here could accelerate the push toward higher price targets. However, traders should watch for any signs of resistance at this crucial level, as it could determine the short-term price direction.

Market Sentiment Analysis

Overall market sentiment remains decidedly bullish, supported by:

- Strong technical indicators

- Positive regulatory developments

- Increasing institutional interest

- Growing market confidence

Risk Considerations

While the outlook appears positive, traders should maintain awareness of potential risks:

- Resistance at $270 could prove stronger than expected

- Market conditions can change rapidly

- Overall cryptocurrency market volatility

Looking Forward

The combination of technical strength and favorable market conditions suggests potential for continued growth. The $300 target by month-end appears increasingly achievable, though traders should maintain proper risk management strategies.

Trading Strategies to Consider

Given the current market conditions, traders might consider:

- Watching the $270 level for breakout confirmation

- Monitoring trading volume for validation of price moves

- Setting appropriate stop-losses to protect against sudden reversals

- Planning entries and exits based on key technical levels