The cryptocurrency community received unexpected news when the Chicago Mercantile Exchange (CME) briefly displayed a webpage suggesting the launch of futures contracts for XRP and Solana. While the page was quickly removed and labeled as an error, its appearance has sparked significant discussion about the future of institutional crypto trading.

Understanding the Proposed Contracts

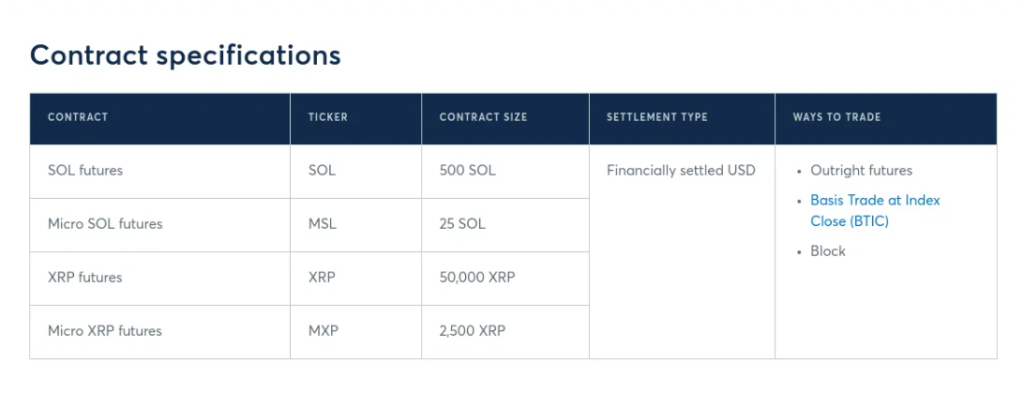

The leaked webpage outlined specific details for two new futures products. For Solana, the plans showed standard contracts of 500 SOL and smaller micro contracts of 25 SOL. The XRP contracts were structured with standard sizes of 50,000 XRP and micro versions at 2,500 XRP. Both would settle in US dollars, following CME’s established pattern with other crypto futures.

Source: CME/Stillio

CME’s Current Position in Crypto Markets

To understand the significance of this potential expansion, it’s worth examining CME’s existing crypto operations. In 2024, the exchange handled an impressive 29.4 million cryptocurrency futures contracts, with a total value reaching $1.7 trillion. These numbers demonstrate the substantial institutional interest in regulated crypto derivatives.

The Changing Regulatory Landscape

Recent changes in the U.S. political and regulatory environment have created new opportunities for cryptocurrency financial products. The reelection of Donald Trump and Gary Gensler’s departure from the SEC have led many to anticipate a more favorable climate for crypto innovation.

Surge in Crypto Investment Products

The market has already seen increased activity in crypto-related financial products:

Traditional Finance Embraces Crypto

VanEck’s proposal for an Onchain Economy ETF shows growing interest in companies driving digital transformation. Meanwhile, ProShares has taken the bold step of filing for a Solana futures ETF, even before SOL futures exist on CME.

XRP’s Growing Institutional Appeal

Several major firms have shown interest in XRP-based products. WisdomTree led the charge with their XRP ETF application in December 2024, while firms like Bitwise, 21Shares, and Canary Capital have followed suit with their own proposals.

Market Implications

The possibility of CME offering XRP and Solana futures could significantly impact the cryptocurrency market in several ways:

Enhanced Price Discovery

Regulated futures markets typically improve price discovery by allowing institutional traders to express their market views through standardized contracts. This could lead to more efficient and stable pricing for both XRP and Solana.

Increased Institutional Access

CME futures would provide traditional financial institutions with a familiar and regulated way to gain exposure to these cryptocurrencies. This could attract new investors who have been hesitant to engage with crypto through existing channels.

Risk Management Options

These futures contracts would offer new tools for hedging and risk management, particularly valuable for businesses and institutions already involved with XRP or Solana.

Current Status and Important Context

Despite the excitement generated by the leaked webpage, CME has officially stated that no decisions have been made regarding XRP or SOL futures. A spokesperson emphasized that the page was part of a beta testing environment and was published by mistake.

Looking Ahead: What This Means for Crypto

Even though the immediate launch of these futures contracts isn’t confirmed, the incident highlights several important trends:

Growing Institutional Interest

The detailed contract specifications suggest serious consideration has been given to launching these products, reflecting institutional demand for regulated crypto exposure.

Market Maturation

The potential addition of XRP and Solana futures to CME’s offerings would represent another step in cryptocurrency’s evolution toward mainstream financial markets.

Regulatory Progress

The fact that such products are being considered indicates growing comfort with cryptocurrency derivatives among traditional financial institutions and regulators.

What to Watch For

As this situation develops, several key factors will be worth monitoring:

- Official announcements from CME regarding their plans for new crypto futures

- Regulatory responses to crypto derivative product applications

- Market reactions to potential new institutional trading vehicles

- Development of similar products by other exchanges

The Bottom Line

While CME‘s leaked webpage may have been premature, it offers valuable insights into the potential future of institutional crypto trading. As the market continues to mature, the introduction of regulated futures for additional cryptocurrencies seems increasingly likely, though timing and specific details remain uncertain.