The cryptocurrency market has witnessed a remarkable development as Cardano (ADA) demonstrates exceptional strength with an impressive 18% surge, breaking through the $0.77 resistance level. This significant price movement marks a decisive shift in market dynamics, potentially setting the stage for further upward momentum in the coming days.

Market Recovery Shows Strong Bullish Structure

The recent price action reveals a robust underlying bullish structure that has remained intact despite previous market corrections. Traders and investors now focus their attention on the crucial $0.85 level, which represents the next significant resistance threshold. Additionally, the current market structure suggests that converting this resistance into a reliable support level could establish a foundation for sustained price appreciation.

The technical analysis indicates multiple support zones that could protect against potential downside movements. Specifically, the $0.77 level now serves as immediate support, while $0.70 represents a critical backstop should market sentiment temporarily weaken. Furthermore, successful consolidation above these levels could facilitate movement toward the psychologically important $1.00 mark.

Source : Santiment

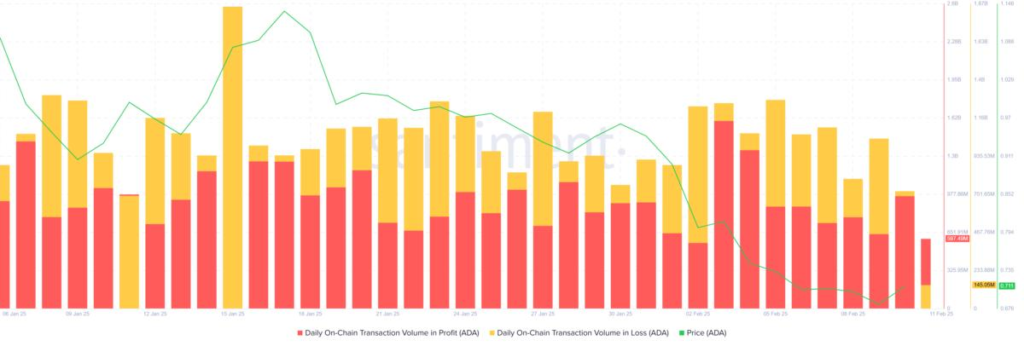

Transformation in Trading Sentiment and Profitability

The preceding month presented considerable challenges for Cardano investors as they navigated through a period of declining prices. Nevertheless, recent market developments have introduced a noteworthy shift in trading dynamics. The ecosystem now experiences an increasing number of profitable trades, suggesting growing confidence among market participants.

This transformation in market sentiment carries particular significance when considered alongside historical trading patterns. The rising volume of profitable positions indicates that traders who maintained their holdings through the correction phase are now seeing positive returns on their investments. Moreover, this improvement in trading profitability often serves as a leading indicator for sustained price appreciation.

ADA Forecast

Funding Rate Analysis Reveals Market Confidence

A deeper examination of Cardano’s funding rate metrics provides additional evidence of improving market conditions. The funding rate, which serves as a key indicator of trader sentiment, has successfully transitioned from negative to positive territory. This technical indicator carries substantial weight in cryptocurrency markets, as it reflects the premium traders are willing to pay for leveraged positions.

The previous two weeks witnessed considerable fluctuations in the funding rate as market participants adjusted their positions in response to changing conditions. The return to positive funding rates signifies that traders are increasingly taking long positions, betting on further price appreciation. This shift in positioning often precedes extended periods of upward price movement.

Strategic Importance of the 0.85 Price Level

The cryptocurrency community now focuses intensely on ADA’s interaction with the $0.85 price level. This specific price point holds strategic importance for several reasons. First, it represents a significant psychological barrier that, once broken, could trigger increased buying pressure. Second, the technical structure suggests that establishing support at this level could create a launching pad for testing higher resistance levels.

The market currently shows promising signs as it approaches this crucial threshold. The presence of a bullish falling wedge pattern adds technical credibility to the potential for continued upward movement. Successfully converting $0.85 into support could accelerate the journey toward $0.99 and potentially beyond.

Technical Analysis Points to Critical Decision Point

Technical indicators suggest that Cardano stands at a pivotal moment in its price evolution. The convergence of multiple technical factors, including increased trading volume, improving funding rates, and the falling wedge pattern, creates a compelling case for continued strength. However, market participants should remain mindful of potential resistance at key levels.

Should the price action fail to establish $0.85 as support, traders must watch for potential retracement to established support levels. The market structure suggests that $0.77 would serve as the first line of defense, followed by more substantial support at $0.70. These levels represent critical areas where buying pressure has historically emerged to counter selling pressure.

Conclusion and Market Outlook

The recent 18% surge in Cardano‘s price represents more than just a temporary bounce. The combination of improving funding rates, increased profitable trades, and strong technical structure suggests potential for sustained upward movement. As the market approaches the critical $0.85 level, traders and investors should monitor volume and price action for confirmation of trend continuation.

The coming trading sessions will prove crucial in determining whether this recovery can transform into a longer-term uptrend. While the current market structure appears promising, participants should maintain awareness of key support levels and potential resistance zones that could influence price action in the near term.