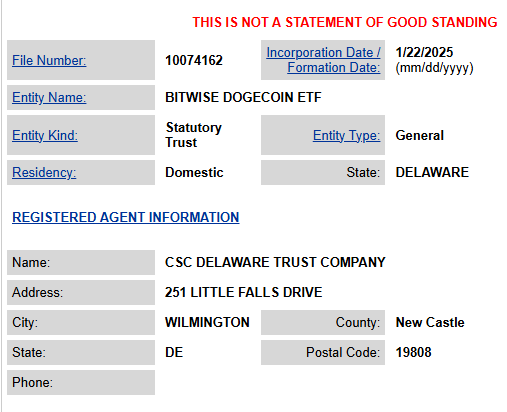

In a groundbreaking development for cryptocurrency markets, Bitwise Asset Management has taken the first step toward launching a Dogecoin ETF. On January 22, 2025, the company registered the BITWISE DOGECOIN ETF as a statutory trust in Delaware, working with CSC Delaware Trust Company to establish the legal groundwork.

Source : Delaware

What Does This Registration Really Mean?

First and foremost, this registration represents a preliminary step rather than a complete SEC filing. However, the impact was immediately evident as Dogecoin’s price surged to $0.373 following the announcement. Meanwhile, the cryptocurrency has maintained strong support near the $0.36 level, demonstrating sustained market confidence.

Bitwise’s Strategic Evolution in Crypto ETFs

Bitwise Asset Management, which currently oversees more than $12 billion in assets, has been methodically expanding its cryptocurrency product lineup. Additionally, their recent moves showcase a clear strategy:

- They launched a combined Bitcoin and Ethereum ETF in October 2024

- Subsequently, they filed for a Solana ETF in November 2024

- Now, they’re positioning themselves in the Dogecoin market

Why This Matters for Investors

The potential launch of a Dogecoin ETF could transform how both institutional and retail investors access the DOGE market. Furthermore, this development offers several key benefits:

- Regulated Investment Vehicle: Investors can gain exposure to Dogecoin through a traditional, regulated financial product

- Simplified Access: No need to deal with crypto wallets or exchanges

- Institutional Grade Security: Professional asset management and custody solutions

The Road Ahead: What to Expect

While the registration marks an important milestone, several crucial steps remain before a Dogecoin ETF becomes reality. According to market analysts, here’s what needs to happen:

- Formal SEC Filing: Bitwise must submit a comprehensive Form S-1

- Regulatory Review: The SEC will evaluate the application thoroughly

- Potential Launch: If approved, the ETF could debut as early as April 2025

Market Implications and Future Outlook

The cryptocurrency market is showing increasing maturity through institutional adoption. Consequently, this ETF registration reflects growing confidence in digital assets as legitimate investment vehicles. Moreover, several factors support the potential success of a Dogecoin ETF:

- Rising institutional interest in crypto products

- Successful launches of other cryptocurrency ETFs

- Growing retail demand for regulated crypto investments

What This Means for Individual Investors

For those interested in gaining exposure to Dogecoin, this development presents new opportunities. Therefore, it’s important to understand the potential benefits and considerations:

Benefits:

- Professional management

- Traditional brokerage access

- Simplified tax reporting

Considerations:

- Management fees

- Trading premiums

- Market volatility

The Bottom Line

Bitwise’s Dogecoin ETF registration on Delaware marks another significant step in cryptocurrency’s journey toward mainstream financial acceptance. Although the final approval remains pending, this development signals growing institutional confidence in digital assets. Furthermore, it potentially opens new doors for both retail and institutional investors to participate in the cryptocurrency market through regulated vehicles.