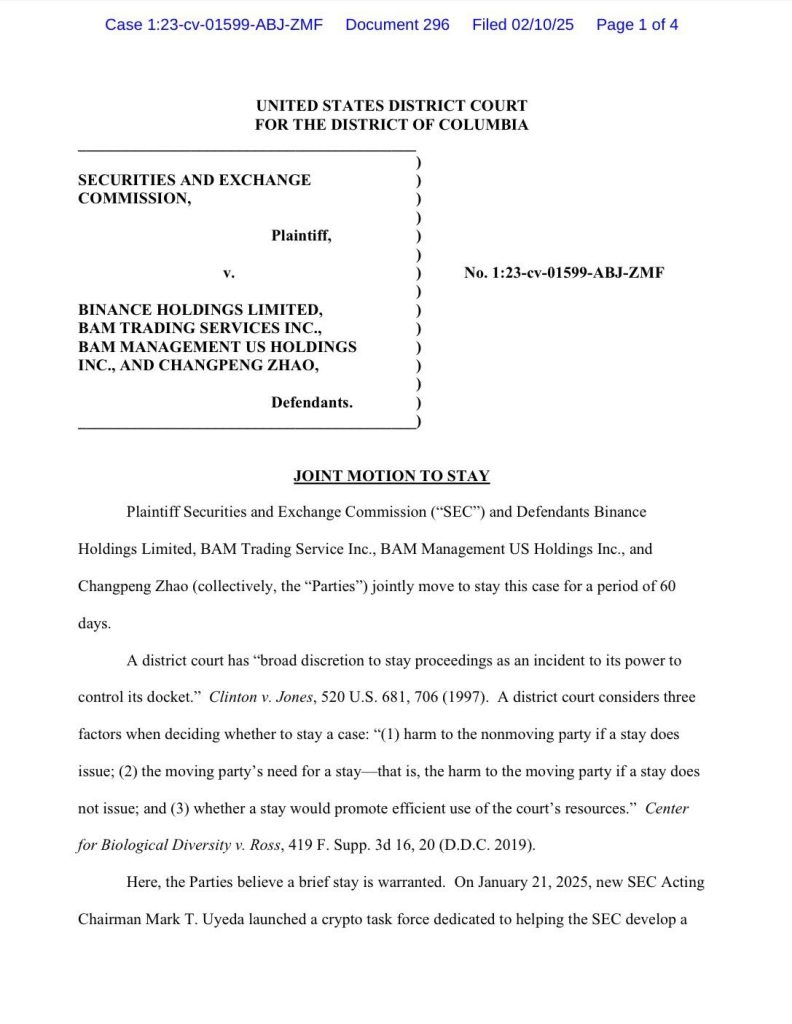

The Securities and Exchange Commission and cryptocurrency exchange Binance filed a joint motion on February 10, 2025, implementing a 60-day pause in their ongoing legal dispute. This development coincides with the SEC’s establishment of a new crypto task force under Commissioner Hester Peirce, potentially reshaping the regulatory landscape for digital assets.

New Regulatory Developments

The formation of the SEC’s Crypto Task Force marks a significant shift in the regulatory approach to digital assets. Under the leadership of Commissioner Hester Peirce, this specialized unit aims to develop comprehensive frameworks for cryptocurrency regulation. The task force’s work could substantially influence the resolution of the SEC’s case against Binance, making the temporary pause strategically valuable for both parties.

SEC vs. Binance: Court Filing Requests 60-Day Case Pause. Source: @EleanorTerrett

Case History and Legal Framework

The legal battle began in June 2023 when the SEC filed charges against Binance, its U.S. affiliate BAM Trading Services Inc., and former CEO Changpeng Zhao. The regulatory body alleged the unauthorized sale of securities and illegal operations within U.S. territories. While Binance attempted to dismiss the lawsuit, Judge Amy Berman Jackson’s July 2024 ruling maintained key elements of the SEC’s case.

Partial Victory and Ongoing Claims

Judge Jackson’s decision granted Binance partial relief by dismissing several significant claims. These included allegations about secondary market sales of BNB tokens, the classification of Binance USD stablecoin as an investment contract, and the broad assertion that crypto tokens inherently constitute securities. However, the court preserved claims regarding Binance’s staking program, BNB’s Initial Coin Offering sales, and various anti-fraud violations.

Strategic Considerations

Both parties view the pause as a prudent allocation of resources, particularly given the potential impact of the new crypto task force. This temporary halt represents the first cryptocurrency-related lawsuit suspension since Mark Uyeda assumed the position of acting SEC chair. Industry observers interpret this development as a possible indication of evolving regulatory strategies under the new leadership.

Resource Management and Efficiency

The joint motion emphasizes judicial economy and resource conservation. Both the SEC and Binance acknowledge that early resolution could eliminate the need for extensive discovery processes and additional legal proceedings. This approach aligns with broader efforts to streamline regulatory enforcement while maintaining effective oversight of cryptocurrency markets.

Industry Wide Implications

The pause could establish important precedents for other cryptocurrency firms facing SEC scrutiny. Companies like Ripple, Coinbase, and Kraken might pursue similar temporary stays, particularly in cases not involving fraud allegations. This development suggests a potential shift toward more negotiated resolutions in cryptocurrency regulation.

Future Proceedings

Following the 60-day suspension, both parties will submit a joint status report to determine the next steps. This report will help decide whether to resume legal proceedings or extend the pause. The arrangement carefully preserves both parties’ legal positions while creating space for potential resolution discussions.

Regulatory Evolution

The temporary pause coincides with broader regulatory changes under the Republican administration. The SEC’s review of ongoing litigation, combined with the new crypto task force’s efforts, could signal a more nuanced approach to cryptocurrency regulation. This evolving landscape might facilitate more collaborative solutions between regulators and industry participants.