In a bold move that strengthens its position in the cryptocurrency market, healthcare technology company Semler Scientific has significantly expanded its Bitcoin portfolio. This strategic investment marks a notable shift in corporate treasury management strategies.

Record Breaking Bitcoin Acquisition

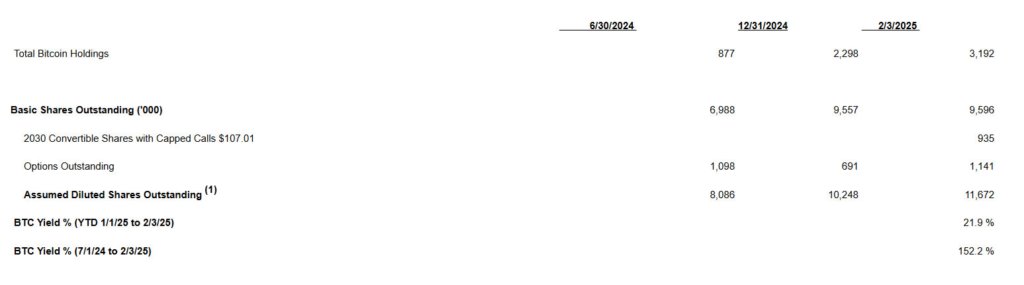

The company has added an impressive 871 BTC to its holdings, bringing its total Bitcoin reserve to 3,192 BTC. This substantial increase has secured Semler Scientific’s position among the top 10 corporate Bitcoin holders worldwide. The strategic accumulation demonstrates growing institutional confidence in cryptocurrency as a treasury asset.

Source: Semler

Investment Details and Financial Strategy

Between January 11 and February 3, 2025, Semler Scientific executed a carefully planned investment strategy. The company invested $88.5 million to acquire the additional Bitcoins, demonstrating strong financial planning and market timing. The funding for this significant purchase came from two primary sources:

- Proceeds from a convertible notes offering

- Partial sale of its minority stake in Monarch Medical Technologies

The average purchase price for this recent acquisition stood at $101,616 per Bitcoin. As of February 3, 2025, Semler Scientific’s total Bitcoin investment has reached $280.4 million, with an overall average purchase price of $87,854 per Bitcoin.

Impressive Returns and Performance Metrics

The company’s Bitcoin strategy has delivered remarkable results. Let’s break down the key performance indicators:

Short-term Performance

- BTC Yield from January 1, 2025, to February 3, 2025: 21.9%

Long-term Performance

- BTC Yield from July 1, 2024, to February 3, 2025: 152.2%

These impressive returns validate the company’s investment strategy and timing in the cryptocurrency market.

Strategic Divergence from Market Leaders

Interestingly, Semler Scientific’s aggressive acquisition strategy stands in contrast to the approach taken by MicroStrategy, the current largest corporate holder of Bitcoin. While MicroStrategy has temporarily paused its Bitcoin acquisitions, Semler Scientific continues to build its position actively.

Market Impact and Future Implications

The healthcare technology company’s successful Bitcoin strategy could influence other corporations considering cryptocurrency investments. Chairman Eric Semler’s expressed satisfaction with the company’s growing Bitcoin stockpile suggests continued commitment to this investment approach.

Understanding the Broader Context

This strategic move by Semler Scientific reflects a growing trend of corporate interest in cryptocurrency assets. The company’s success demonstrates how traditional businesses can effectively integrate digital assets into their treasury management strategies while maintaining their core business focus.

Long-term Perspective

The substantial returns achieved by Semler Scientific‘s Bitcoin investment strategy highlight the potential benefits of well-planned cryptocurrency investments for corporate treasuries. Their approach combines careful market timing with strategic funding sources, providing a model for other companies considering similar investments.