While Ethereum’s recent price movement has been disappointing for investors, trading at $3,337.68 after an 11% monthly decline, several market indicators suggest a potential turnaround. Furthermore, these signals point toward a possible rally to the $4,000 mark.

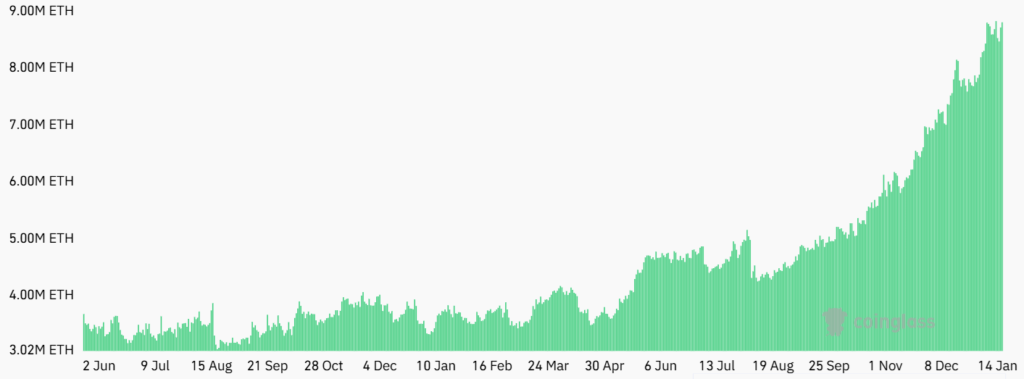

Record-Breaking Open Interest

The futures market is showing remarkable activity. Moreover, the numbers tell an interesting story:

Ethereum futures aggregate open interest, ETH. Source: CoinGlass

- 9 million ETH in open interest – an all-time high

- 10% increase over two weeks

- 54% controlled by major exchanges

- Strong interest despite $3,000 support test

What This Means for Traders

High open interest typically indicates:

- Growing market participation

- Increased trading opportunities

- Potential for significant price movements

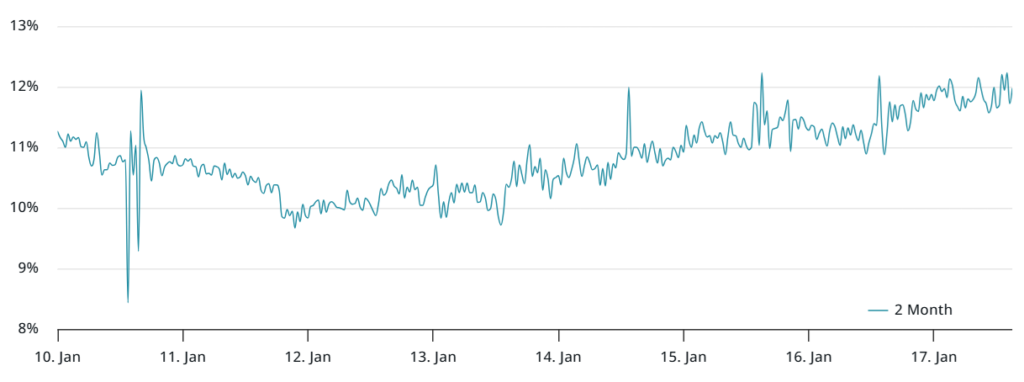

Futures and Options Show Optimism

Ether futures 2-month annualized premium. Source: Laevitas

The derivatives market presents encouraging signs:

Futures Premium

- Current rate: 12% (up from 10%)

- Normal range: 5-10%

- Indicates stronger buyer confidence

Options Market Health

- 25% delta skew at -4%

- Suggests balanced market conditions

- Slightly favors upward movement

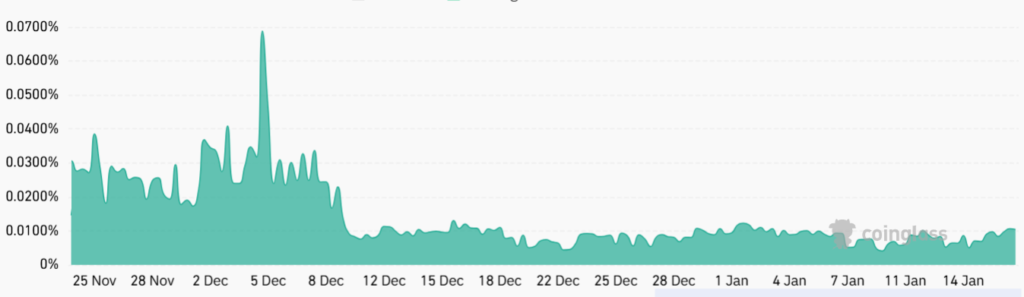

Stable Retail Market Participation

Current market conditions show healthy retail involvement:

- 0.9% monthly funding rate

- Balanced leverage positions

- Lower risk of sudden price swings

- Sustainable trading environment

Economic Factors Supporting Growth

Several external factors support potential price growth:

Federal Reserve Impact

- Softer inflation data

- Expected interest rate cuts in 2025

- Favorable conditions for crypto assets

Institutional Support

- Active purchasing by World Liberty Financial

- Growing institutional confidence

- Alignment with pro-blockchain policies

Understanding Market Metrics

For newer investors, here’s what these indicators mean:

- Open Interest: Shows total active futures contracts

- Futures Premium: Indicates market expectations

- Delta Skew: Measures options market sentiment

- Funding Rate: Shows leveraged position balance

Ether perpetual futures 8-hour funding rate. Source: CoinGlass

Price Targets and Support Levels

Key price levels to watch:

- Current Price: $3,337.68

- Support Level: $3,000

- Target Level: $4,000

What Could Drive the Rally?

Several factors could push Ethereum toward $4,000:

- Increased Trading Volume: More market participation

- Institutional Buying: Continued large-scale purchases

- Market Sentiment: Growing investor confidence

- Economic Conditions: Favorable monetary policy

Looking Ahead

While past performance doesn’t guarantee future results, the current market indicators paint an optimistic picture. Nevertheless, investors should:

- Monitor key support levels

- Watch institutional activity

- Track market sentiment changes

- Stay informed about economic factors

Conclusion

Despite Ethereum’s recent price decline, multiple indicators suggest potential for recovery and growth. The combination of record open interest, positive futures premiums, balanced retail sentiment, and supportive economic conditions creates a foundation for possible price appreciation toward $4,000.